What mobile apps come to mind when you think of Japan? Perhaps the messaging app LINE? Or the e-commerce giant Rakuten Ichiba? Or perhaps various gaming apps, or even manga apps?

Japan’s mobile app landscape is truly expansive. In this article, we’ll explore the latest popular Japanese apps to provide a deeper understanding of the country’s mobile ecosystem.

Smartphone Penetration in Japan Continues to Grow

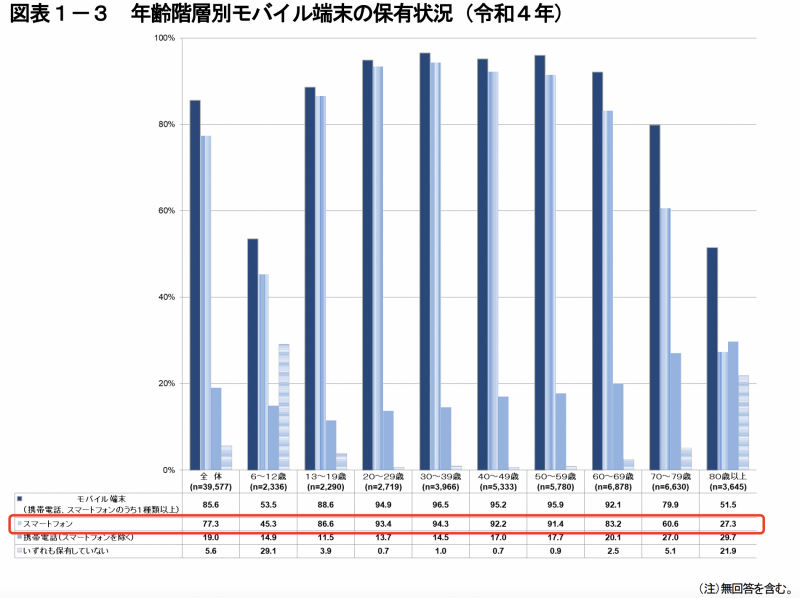

According to the Communications Usage Trend Survey released in 2023 by the Ministry of Internal Affairs and Communications, personal smartphone ownership in Japan has reached over 90% of the population as of 2022, marking a significant increase compared to 67.6% in 2019. Although ownership tends to decline with age, a substantial 83.2% of those in their 60s and 60.6% in their 70s still own smartphones.

Japanese Smartphone Usage

A survey conducted in July 2023 by MM Research Institute found that the average smartphone usage in Japan was 1,189 minutes (around 20 hours) per week, a 7-hour increase from 2019.

Breaking down by usage purpose, the most popular activities are:

-

“Internet searching/information gathering,” accounting for about 226 minutes (3.8 hours) per week

-

“Social media”, with 195.5 minutes (3.3 hours).

-

“Watching videos” with 160 minutes (2.7 hours).

When asked about daily app usage, 30% of respondents responded that they use more than seven apps. Meanwhile, 30.9% used four to six, and 34.1% used one to three apps. Social Media, News, and Weather are the most frequently used app categories in Japan.

Top Apps in Japan 2023

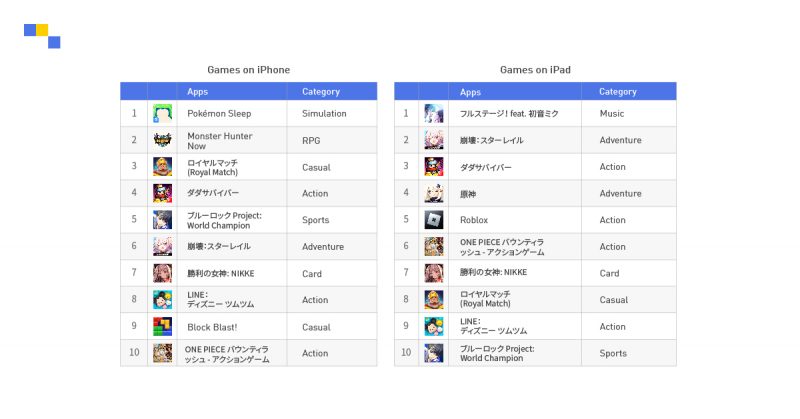

Apple’s annual ranking reveals that the top 10 most downloaded non-game iPhone apps in 2023 cover a diverse range of categories.

-

Compared to 2019, there has been an increase in utility apps like Mynaportal and Mynapoint.

-

In non-gaming, video apps continue to be popular; although only two have made it into the iPhone’s top 10. Half of the top 10 downloaded apps available on iPad are related to video streaming.

-

Social Media apps have a smaller share in download volume; nevertheless, they are among the most frequently used, especially with the emergence of “super apps” such as LINE.

Video-Related Apps Remain Popular

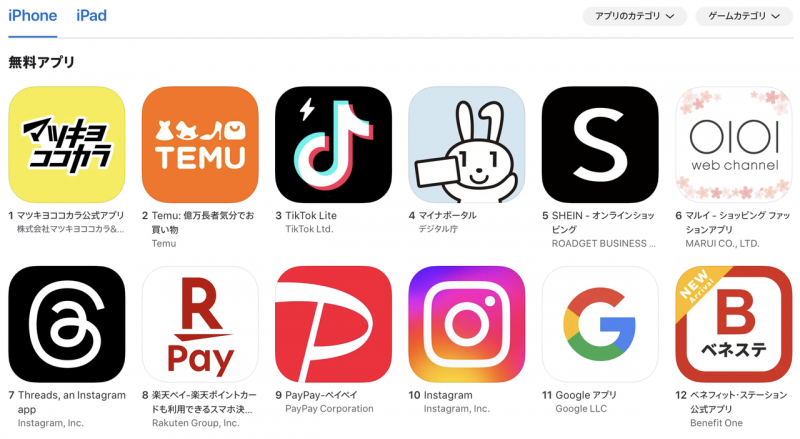

The app rankings underscore the enduring appeal of video content. From the chart above, we can see that two video and streaming apps, TVer and TikTok, are among the top 10 free downloads for iPhone, and the iPad’s top 10 features YouTube, TVer, Amazon Prime Video, ABEMA, and Netflix.

Nielsen Digital’s report reveals that YouTube remains the leading video streaming platform in Japan, with over 73.7 million MAU and accounting for 37% of the total usage time among Japanese viewers. At the same time, TikTok and TVer have seen remarkable surge in viewership as both grew more than 1.5 times over the previous year, as TikTok reached 31.68 million users and TVer reached 17.85 million.

Competition between Video Services Is Intensifying

The video streaming market remains competitive in Japan, featuring foreign services like Amazon Prime Video, Netflix, Disney+, and local competitors like TVer and U-NEXT.

In 2019, popular video services such as Disney DELUXE & Apple TV+ were launched in Japan, which caused the competition for market share to become more intense than ever. As of 2023, the Japanese market had over 52 million subscribers across premium VOD services, generating $4.5 billion in subscription revenue.

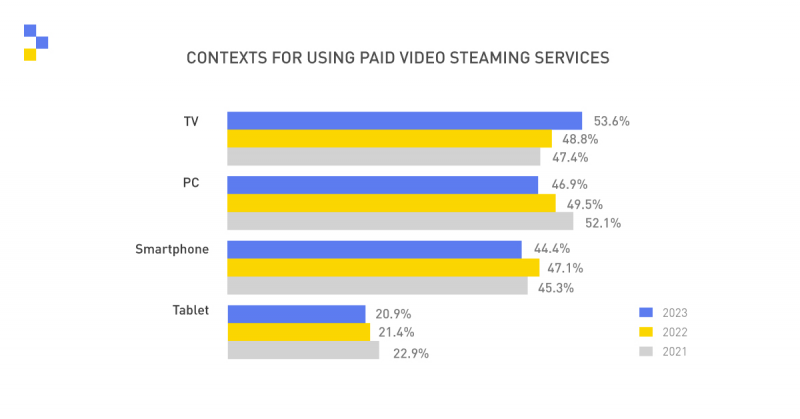

While smartphones continue to be the main driver for video streaming service usage in Japan, the introduction of connected TV has increased TV usage. A survey examining devices used for viewing paid video streaming services showed that the ‘share of TV’ has increased to 53.6% in 2023 from 48.8% in 2022.

Netflix was the leader of Japan’s subscription service in 2022, but the competitive landscape has shifted the rankings. In 2023, Amazon Prime Video became the leader, capturing 23% of total subscription revenue, with Netflix close behind at 21%. Although Prime Video entered Japan’s streaming market after Netflix, it has gained more popularity, securing 19.7 million monthly active users (MAUs) compared to Netflix’s 7.5 million. However, users of Netflix tend to consume more content due to the wide selection of localized videos.

Competing against the popularity of these global companies are Japanese broadcasting companies. TVer, an AVOD service allowing users to catch up on missed programs from commercial TV stations, reached 35 million MAUs in January 2024. Meanwhile, U-NEXT, backed by Usen-Next Holdings and TBS Holdings, has 8.2 million MAUs. Additionally, there is a flood of video services from other broadcasting companies, including FOD (Fuji TV On-Demand) and NHK On-Demand, Abema TV by CyberAgent, and TV Asahi.

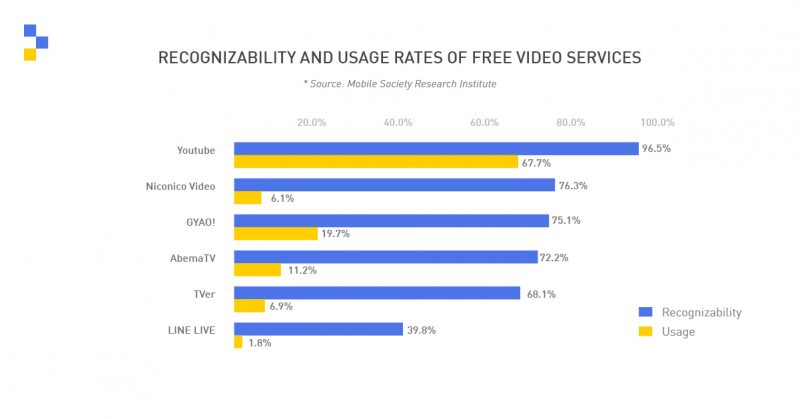

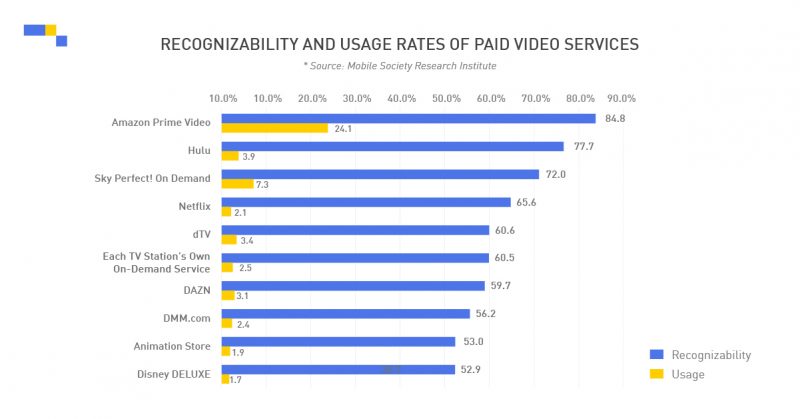

According to a survey on the recognizability and usage rate of video services conducted by NTT Docomo Mobile Society Research Institute, YouTube usage was the No.1 free video service with 67.7% market share, while Amazon Prime Video was the top paid video service with 24.1% market share.

Despite common perceptions that young people are moving away from traditional TV, research by the Media Environment Research Institute suggests otherwise. It turns out that teenagers show a strong preference for TV programs; in fact, 35.2% of teenagers regularly watch on TVer. This platform has the highest recognition and usage intent among teenagers, especially among young females. Teenagers show a strong inclination to watch, with their interest in watching dramas largely influenced by the buzz these shows generate on social media platforms.

TikTok is also perceived more as an entertainment video platform than a social media platform, and its algorithm has captivated many users. As people increasingly look to make the most of their limited time with valuable content, TikTok’s ability to present content that aligns with their explicit interests and also introduces potentially engaging topics that significantly enhance the viewing experience.

Utility Apps Are on the Rise

Utility apps are becoming more relevant for Japanese people looking to manage their daily tasks on their smartphones. Over the past few years, there has been a significant increase in both installs and sessions for utility apps. Such apps offer solutions for privacy, productivity, and convenience, with such features as personal identification management, rewards programs, and ad-blocking.

In App Store’s 2023 top free non-game app list, Mynaportal and MyNaPoint secure the first and the second spot. Mynaportal is a one-stop online administrative service by the Japanese government, and MyNaPoint is part of the government’s measures to encourage the use of My Number Cards and cashless payments to boost consumption.

In its top paid non-game app list, 280blocker ranks at the top, followed by EE35 フィルムカメラ (an app that allows users to have fun with a retro camera) and AutoSleep (a sleep tracker).

Shopping Apps Ascending in Popularity

When surveyed about the types of apps they use, respondents ranked shopping apps second for “at least once a week” and first for “at least once a month.” So, although SHEIN was the only shopping app on Apple’s 2023 top 10 free non-game app list, it’s no surprise that the list in March 2024 features four shopping apps in the top 10: マツキヨココカラ公式アプリ (MatsukiyoCocokara), Temu, SHEIN, and マルイ (Marui OIOI).

The success of brands like MatsukiyoCocokara has a strong relationship with brick-and-mortar shopping. is a famous beauty and drug brand with hundreds of offline stores across Japan.

While local giants such as Rakuten and Mercari maintain their position in the download chart, foreign apps such as Temu and SHEIN are gaining popularity, appealing to the Japanese market with competitive pricing. This trend reflects a shift among Japanese consumers toward greater price consciousness, demonstrating a growing preference for cost-effective, value-oriented shopping.

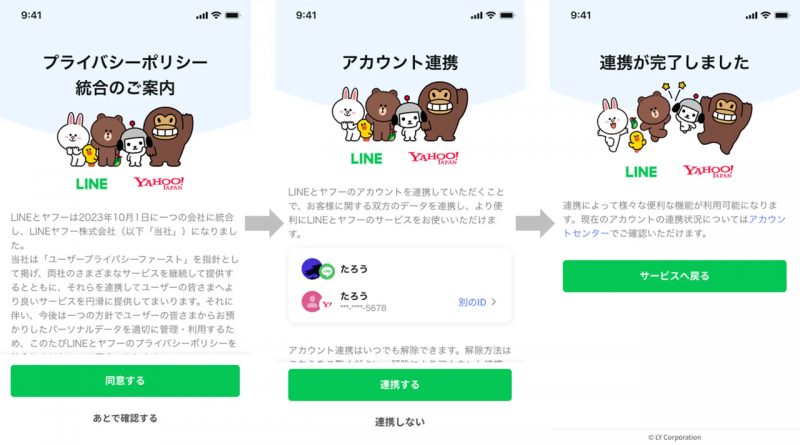

The Yahoo! & LINE Integration

The announcement in 2019 of the integration between Yahoo! Japan and LINE has been one of the biggest news in the Japanese mobile industry. This strategic move by Z Holdings underscores its ambition to become a global leader in artificial intelligence.

LINE has about 198 million MAU and Yahoo! Japan has about 84 million MAU, so this integration gave birth to Japan’s largest tech company with over 250 million members using search, e-commerce, instant messaging, payments, and more.

In the field of mobile payments which has become highly competitive in Japan, the integration between Yahoo!’s PayPay and LINE’s LINE Pay is getting attention. For context, PayPay is integrated with over 1.7 million affiliate stores and LINE Pay users can use their smartphones to make mobile payments at any PayPay affiliate.

Japan’s Digital Advertising Growth

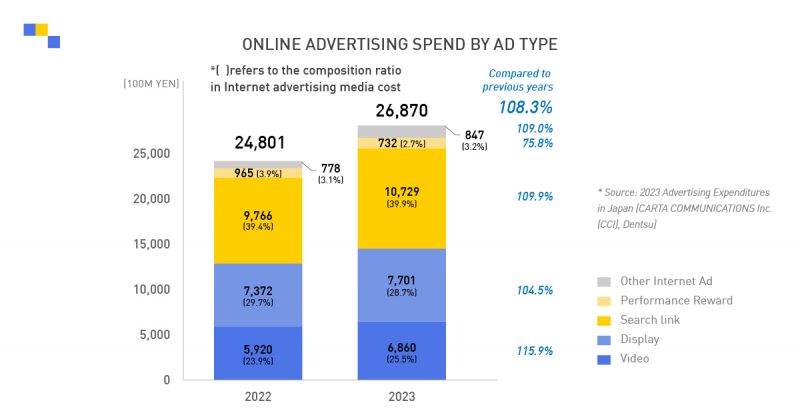

Dentsu Group has reported that, in 2023, the total advertising expenditures in Japan amounted to 7.3 trillion yen, or $49.6 billion, a 3% increase from the previous year. The growth of Japan’s advertising market was primarily driven by an increase in online advertising expenditures, which reflects the ongoing digital transformation, and the rise in spending on promotional ads, especially for events, exhibitions, and screen displays, as people’s movement and activities increased.

Programmatic advertising reached 2,349 billion yen ($15 billion), marking a 110.9% increase from the previous year and accounting for 87.4% of total online advertising expenses.

Breaking down by ad formats, video ads showed the most growth at 686 billion yen ($4.7 billion), representing a 115.9% YoY increase and 25.5% of total ad spend. Video advertising is expected to maintain a double-digit growth to 769.7 billion yen ($5.2 billion) in 2024, representing a 112.2% YoY increase.

What is the Future of the Japanese Mobile Market?

The next-generation communications standard, 5G, was launched in Japan in the spring of 2020. Thanks to its ability to send data 100 times faster than the current communications standards, 5G enables people to enjoy a wide range of content including VR (virtual reality), AR (augmented reality), and high-quality videos.

There is marked anticipation for use cases other than smartphones, such as self-driving cars and remote medical care. As of June 2023, Japan’s 5G network has achieved a population coverage rate of over 90%. Japanese mobile carriers are also investing heavily to expand their networks, aiming for 5G coverage to reach 99% of the population by 2031. By then, the way we use our smartphones might change as well, but how exactly, that remains to be seen.

If you’re looking to achieve success in Japan’s mobile market, contact the Nativex team today. With a wide range of mobile marketing solutions available, our team can help global brands and advertisers reach their audiences in Japan and other key markets around the world.

Want to learn more about different social media app marketing in China? Take your pick from our “what is” series on WeChat, Xiaohongshu, Weibo, Naver, and Kwai. You can also keep your eye on the blog for more updates.

Ready To Grow Your App In China?

China is home to the largest mobile market in the world. In this eBook, we take a look at how Nativex can help you bridge the cap and successfully run your advertising campaigns in the region. Learn more about our media buying solutions, our influencer marketing expertise, creative production, and more.

" alt="">

" alt="">