Influencer marketing has become one of the most popular and effective ways for Western brands and apps to speak directly to their customers.

Influencer marketing is also a big deal in the east, particularly in China. What you may not know is that their version of influencer marketing is on an entirely different level to what you may have seen before.

In China there has been a huge growth of ‘social commerce’, where established social media platforms like Taobao and Douyin work with influencers to create a hybrid of social media content and online shopping.

eMarketer’s forecast for 2020 expects $242.41 billion (RMB1.675 trillion) will be spent on social commerce this year, up from $186.04 billion (RMB1.285 trillion) last year.

33% of influencer recommendations result in sales, and shops see an increase of 120% for in-store sales following an influencer’s endorsement.

It’s influencer marketing, but not as we know it. And, with the right approach, western brands can work with those influencers to enter lucrative markets in China and reach out to new audiences.

Introducing KOLs – the face of online retail in China

First, it’s worth getting the word ‘influencer’ out of your mind completely.

‘Influencer’ is more of a western term. In China, influencers are better known as Key Opinion Leaders, often shortened to KOLs.

A KOL is very similar to a western influencer; a popular personality with a large social media following that can help convert fans and followers into shoppers.

In China the KOL industry is huge, with the live-streaming economy valued at approximately 961 billion yuan (US$137 billion) in 2020 – that’s 4% of all ecommerce sales.

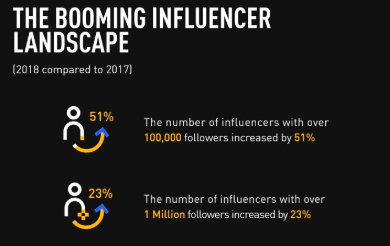

As our eBook also points out, China’s influencer economy is expected to continue expanding at a CAGR of 42% from 2017 to 2022.

A large portion of KOL revenue comes from ad spend as more and more brands and agencies look to partner with leading KOLs to reach out to new, younger markets.

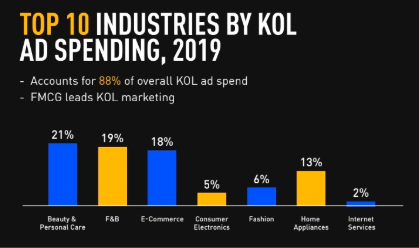

60% of brands focus on KOL marketing, making it China’s most popular digital marketing channel. In 2019, KOL ad spend saw YOY growth of 63%, with beauty and personal care, food and beverage, and eCommerce sectors leading the way.

Why are KOLs so popular in China?

KOLs are popular in China for a lot of the reason influencers are in the west. Their followers put a lot of trust and authority into their recommendations, and are more willing to spend on that basis. KOLs are also, at their most basic, about entertainment and personality.

The popularity of KOLs also lend themselves to technological and demographic differences between east and west. Technologically, a purchase is currently a lot easier for a KOLs followers to make in China. Live streaming is hugely popular, and certain platforms let followers make a purchase during a stream at the click of a button.

The concept of an entertaining KOL pushing a product live and users being able to make an instant purchase has been a hit, with sales revenue in China’s live-streaming market more than doubling between 2019 and 2020.

China’s tech giants have worked hard for the past few years to make that system as seamless as possible, with tech companies in the west lagging far behind.

Douyin, WeChat, Kuaishou and others have introduced numerous easy-to-use social commerce measures to users, with KOLs enhancing their success.

Relative newcomer Kuaishou, in fact, has used KOLs and social commerce to boost growth and steal a march on its closest rival, Douyin, with conversion rates up to five times higher than its competitor.

The rise of China’s social-engaged youth market

Away from the tech lies a very simple reason for the success of KOLs.

Younger, more social commerce-savvy markets are coming of age, who have money to spend and are natural, native users of digital technology.

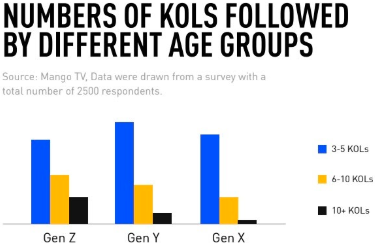

Usually labelled ‘Gen Z’, the data we collected for our eBook shows just how engaged the younger generation is with KOLs and the impact they have on retail.

45.5% of those classed as Gen Z, for instance, made a spontaneous product purchase after viewing a KOL’s recommendation. Not far behind is Gen Y at 42.5%, with only 21.5% of Gen X making a purchase.

Other data shows just how connected China’s Gen Zers and the country’s KOLs are. 48% of Gen Z shoppers would check a KOL’s suggestion before committing to a purchase, while a quarter of Gen Z’s monthly spend is influenced by KOLs.

On the other side, when looking at KOL fanbases, 54% are firmly Gen Z or born after 1995. Lagging far behind at 23% are followers born between ’90 – ’95, with fans born between ’85 – ’90 third at 12%.

The future of shopping is here today in China, and is being fuelled by young shoppers. China’s Gen Z consumers account for 13% of household spending; over four times higher than the US Gen Z audience, according to Bloomberg.

We’ve helped many brands and developers work with top KOLs in China to boost their marketing ROI. Download our free ebook to find out how you can use KOL Marketing to achieve success in the world’s largest mobile market.

1 DOWNLOAD EBOOK⟶The role of Multichannel Networks in China’s KOL economy

The KOL movement is more than a flash in the pan, too. Over 54% of Chinese Gen Zers listed ‘live streamer’ (or ‘wanghong’) as their dream profession, according to WGSN.

They also highlight how The Chongqing Institute of Engineering, a college in southwest China, went as far as partnering with a local company to offer a three-month programme on how to become a better live streamer.

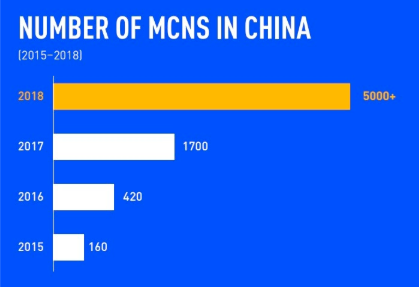

That clamour amongst Gen Z to become a KOL has led to the rise of Multichannel Networks (MCNs); agencies that sign and represent KOL talent, finding them business opportunities usually on a commission basis.

In 2015 there were 160 MCNs in China, by 2018 there were more than 5,000 MCNs; the vast majority of top- and mid-tier KOLs are currently in a partnership with an MCN.

While an MCN makes it easier for a KOL to get new work opportunities, promote them and other services, they’re also beneficial for advertisers, too.

Working with an MCN may work out cheaper for a brand or advertiser, as MCNs can have access to traffic package deals with the country’s leading social media services. However, MCN’s will typically only have contracts with a limited number of KOLs, and the cost of working with them can vary hugely as there is no standardised pricing.

This means that advertisers who want to work with KOLs may find it difficult to reach a huge pool of KOLs at scale, and at a reasonable price. To address this, Nativex has partnered with more than 20 MCNs, as well as establishing direct relationships with more than 40,000 individual KOLs. As an independent agency, this gives Nativex the ability to provide advertisers with unbiased talent matching.

How western brands & publishers can partner with the perfect KOL

The potential returns when partnering with the right KOL are phenomenal, as we’ve highlighted.

Those returns go beyond the financial, too. Getting your brand and apps in front of a youthful Chinese market in the right way can help with long-term brand recognition and help your brand better integrate with a new culture.

It’s something luxury brands are currently doing to great effect. With Bain reporting China’s Gen Z market is set to consume over 55% of the luxury brand market by 2025, Prada, Louis Vuitton and Burberry are just some of the big-name brands investing in KOL marketing.

That can be a much trickier prospect for brands who don’t have Prada-sized budgets and prior knowledge of the Chinese market, though.

With thousands of MCNs out there, a plethora of KOLs to choose from, a foreign market to navigate, language and culture to learn, and regulations to adhere to, it can be extremely difficult for western brands to enter what is an incredibly lucrative new market.

That’s where Nativex can help. We collaborate with over 20 of China’s top domestic MCNs and more than 40,000 KOLs across over 10 common verticals to introduce western brands to new audiences in China.

As a performance-focused agency we connect your investment in KOLs with real, measurable results.

We’re a core agency with Douyin and Bilibili, and also a strategic partner of Weibo, Kuaishou, Red and Taobao. We’re also trusted by more than 2,000 global advertisers including big name partners across the games, e-commerce, FMCG, utilities, video and photo industries.

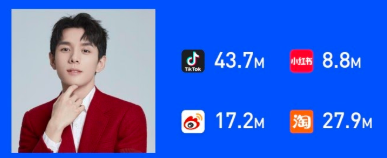

Case study: Boosting sales and brand reputation with China’s ‘Lipstick King’

We partnered with KOL Li Jiaqi, also known as China’s ‘Lipstick King’, to promote a renowned Japanese multinational personal care company’s special edition skincare set.

Also known as Austin Li, the Lipstick King is also a Guinness world record holder and, arguably, the Number One KOL in the beauty products vertical.

Li has previously helped Alibaba to sell $145 million in one Singles’ Day, 15,000 lipsticks in five minutes on Taobao, helped Jinzi Ham sell 100,000 products in five minutes and increased the company’s market value by over $100 million in two days.

27-year-old Li is now a millionaire and, in 2019, made it on to the Hurun China Under 30s To Watch list.

Li’s appeal as a KOL is easy to see; he’s relatable to his audience, working as a behind-the-counter shop assistant for L’Oréal in Nanchang, a second-tier city in China, before he found fame.

His personality is daring, and his no-holds-barred critical approach to products he deems unworthy (and cat-calling luxury brands such as Chanel) has endeared him to millions.

Though brands fear him, Li is charitable, donating over 40,000 masks to Wuhan during the Coronavirus pandemic.

In short, Li is a beauty KOL like no other in China. He also has over 40 million fans on Douyin and more than 17 million Weibo fans.

Partnering with Li, we were able to help our client tap into his enormous audiences. Li unboxed the product during the 618 Shopping Festival, live streaming a 3 minute 30 second speech about its key features to fans.

Short videos featuring Li and the product were also filmed and promoted during the Dragon Boat Festival. Videos included key product features, prize draws and cross-promotion with the brand’s official Weibo page.

The product was also featured across Li’s account on key social media platforms including Douyin, RED, Kuaishou, Weitao, and Weishi.

The campaign’s end results were extremely impressive. The partnership with Li saw the branded videos attracting over 20 million views across seven mainstream platforms in China, amassing more than 120,000 engagements resulting in greater brand recognition and a sales boost.

This case study and others alongside a greater overview of our approach and strategy can be found in our eBook ‘THE POWER OF INFLUENCER MARKETING IN CHINA’. Click here to download.

Are you a western brand or app looking to partner with the right KOL as part of your wider China growth and branding strategy? Nativex can help – contact our team today to find out more.

Dini is a KOL Marketing Strategist at Nativex. With over 6 years of experience in Marketing and Journalism, Dini has a deep understanding of how to create innovative and successful KOL marketing strategies for brands and advertisers around the world. Prior to joining Nativex, Dini has worked at Fortune 500 companies, where he worked with tech giants Tencent, NetEase, ByteDance, and Sina, as well as top-tier Chinese media including CCTV and Xinhua.

" alt="">

" alt="">